16.4.13, 15:00 - Dies und Das

gepostet von web doc

3 Weeks ago I had to laugh hard in the rooms of my home bank "Frankfurter Sparkasse". (click the link to laugh with me) Very new posters were setted up stating "Invest in Gold now". gepostet von web doc

Well I have never been a friend of gold as exchangecurrency, because of multiple reasons:

1. You can not use it except for electronics or beauty.

2. The price you will be given in case of an outsale is the one somebody is willing to give. Like concrete, just you can not live in gold.

3. Everybody was already talking about a gold bubble.

So, me as an semi expert in a bank full of greedy bankers, trying to rip off greedy customers, but so obviously dumb... I just had to really lough (seriously! I started laughing in the entrance hall). What an epic fail... Not the first time I do not understad how a bank, trying to be trustful is acting opposite.

And, plop, 2 weeks later the goldprice is falling to a moderate level. And I have no mercy for those trying to be smart, buying the goldshit.

The Euro is loosing trust, mostly because of the ECB and it's way to save the currency. Printing money (=lowering the interest rate to a near zero level) and the declaration to buy euro zone government bonds without boundaries if needed is a strange way to keep the fire burning.

I really do understand peoples fear of Inflation and the need to change your money into something trustful.

Why not trade your money to bitcoins? The global ammount of money cannot be modified (except by mining), The community is taking care that nothing happens to your money, it cannot be stolen for example.

The first reason not to do so is: you are not big enough. If a really big form like "GS" is buying bitcoins, the exchangerate will boost up, and if they decide to blow it away it will fall very deep within one day. Bitcoins are a virtual good traded on a market, and if you re read the reasons for not jumping in the gold pool, the same reasons exist here: you will only get what someone else is willing to pay.

And now all the scientific consensus can be called: http://techcrunch.com/2013/04/14/iterat ... ns-future/

It's hard to believe, but I still think it is a good idea to keep BC's in mind, at lest from a certain point in the future where the exrate is more stabil. First of all it is a currency the government and the banks have no influence on, which means that you can use it worldwide without a bankaccount. no transfer fees, no impolite questions about the origin and the usage.

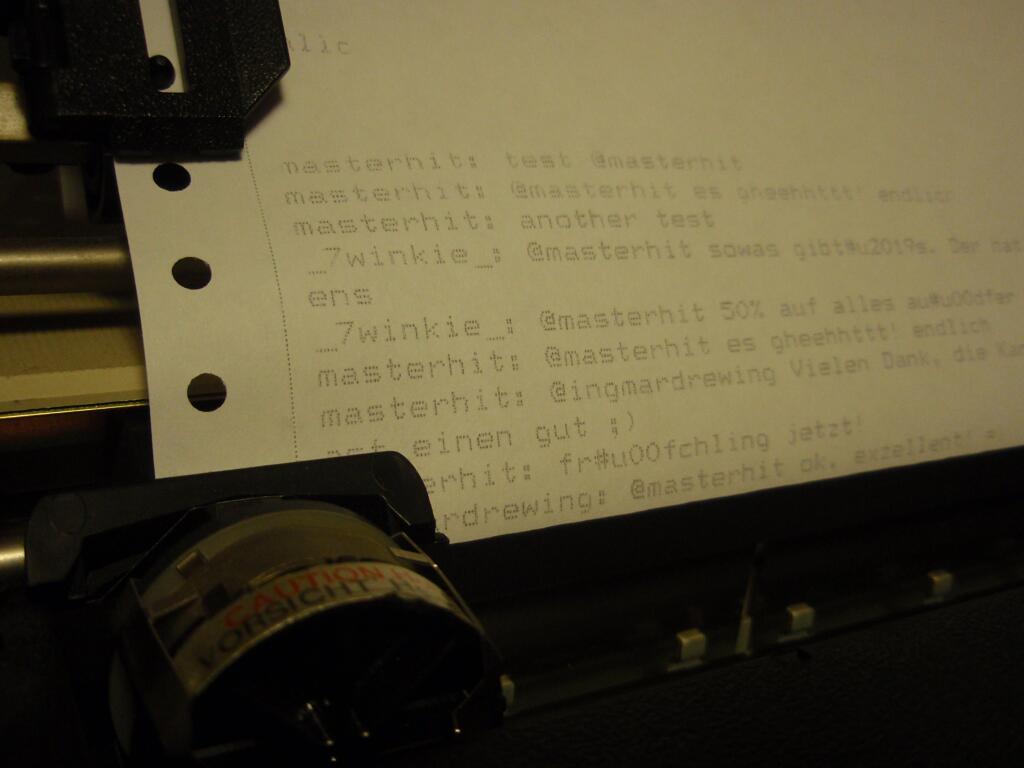

In my twitter correspondence we were discussing the legitimation of Bitcoin, but which legitimation does the Euro have? Did we have the chance to vote about it? Would be nice if so... (thanks for that point Ingmar) The ECB must take it's primary goal serious, and also should never ever back away from the gonvernments. If they are able to prove this in the near future, the eurozone is able to get it's old strength.

One last word:

Inflation is just theft from the poor and it will never matter in the long run.